-

2105 S Bascom Ave, Suite 230

Campbell, California 95008, US

-

408-709-1300

- LET'S CONNECT

APPROACH

Our Multifaceted Platform Delivers Data Driven Solutions

- Private equity firm specializing in core+, suburban, and value-add assets

- Seasoned leaders with decades of partnership investment, property management, asset management, and brokerage expertise

- When we bring you a deal, it meets agreed-on investment criteria

- Our proprietary stress testing, location and asset report cards streamline the evaluation process for our clients

- EMI’s uniquely dedicated asset management team leverages our suite of real time property performance dashboards and reporting; enabling us to execute our asset protection and NOI performance initiatives with comprehensive insight

- We partner with best in class professional management based on local expertise and capacity to execute our multifaceted business outcomes for each asset including bespoke rebranding, asset protection, and value-add services and upgrades

- Because it’s the right thing to do and it’s good for returns, EMI proudly leaves every asset better than when we bought it. Our programs include reducing use of natural resources with Green initiatives, increasing the quality and usability of amenities for our residents, providing meaningful resident lifestyle services, local community engagement and contribution events for the staff and residents.

EMI’s 6 Pillars of Excellence

Multi-faceted Deal Sourcing

Our deal sourcing leverages 30 years in brokerage, financing and investing relationships. Our outreach programs to brokerage firms, developers, and owners directly, generate continuous opportunities for our rigorous underwriting and due diligence.

Proprietary Evaluation Reports

Proprietary Stress Testing, Location and Asset Report Cards coupled with our stringent underwriting enable our clients to use our team as an extension of their own analysis efforts.

Curated Asset Plans

No cookie cutter value-add programs. Our property specific business plans start before acquisition and set the outcomes for 90 days, 6 months, annual, and exit strategy. They serve as our blueprint for driving value. Capital intensive projects are tested for market response before full committment.

In-House Asset Management

Our Asset Management team is solely dedicated to protecting equity and driving value using real time KPI and Variance Dashboards which free them up to drive the execution of the ownership strategy.

Transparent Financial Reporting

Combining institutional level software with our strategies, we aim to provide financial reports and data that replace or are directly usable for your end deliverables.

Making a Social Difference

EMI proudly leaves every asset better than when we bought it. Our programs include reducing use of natural resources with Green initiatives, increasing the quality and usability of amenities for our residents, providing meaningful resident lifestyle services, and engaging in local community and contribution events for the staff and residents.

Our approach

A Fundamental, Data-driven Approach to Multifamily Investing

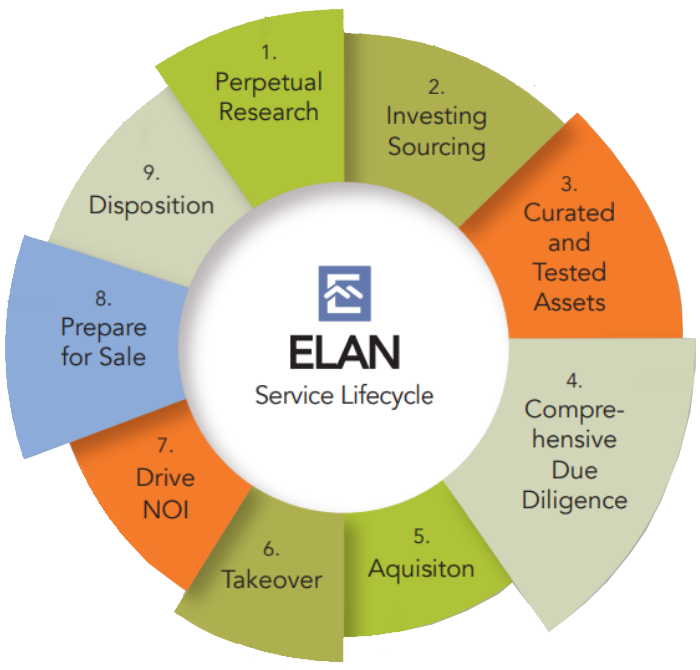

- By continuously scrutinizing economic, social, and governmental conditions, we are able to remain agile while executing our multifaceted strategies through all phases of the lifestyle of real estate investing.

- Our Investors receive fresh opportunities, mined with our 35-year brokerage history, from our copious network of industry experts, and our own outreach initiatives to owners and developers

- Our proprietary asset and location report cards save our clients time and expense when evaluating our curated investment opportunities.

- To protect our clients, EMI engages industry experts to verify each asset’s income stream is from qualified residents; ascertain the construction and finish conditions, and evaluate market conditions including crime stats and competitor analysis.

- We guard against risk with seasoned legal, escrow, inspection and lending colleagues. Our closing team transparently manages the purchase process and competitively right sizes the debt.

- Our clients trust us to test, measure, and adjust quickly. With local nationally accredited third-party management, implementation of EMI’s asset-specific business plan starts on day 1 of our 90-day intensive, multifaceted takeover. We constantly test our assumptions, adjust as appropriate, and implement our differentiating branding program.

- ($1,000 NOI @ 5% CAP = $20,000 property value)We maximize asset value, create fulfilling careers and engaged communities with our integrated asset management services. Persistent competitive positioning and lifestyle enhancements are driven by our fully engaged asset management team. Transparent reporting gives our investors top down traceability.

- Our brokerage history taught us how to position assets for sale. First we maximize the credibility of the property value and market appeal; we competitively source the sales brokerage firm; and compile the full breadth of asset records to ensure the buyer and lender have a clear road to closing.

- Optimizing for returns with investor protection we are fully engaged with legal, escrow and operational safeguards throughout the sales escrow process and prepare the transition to the next investment for our clients.